In the United States, millions of individuals remain uninsured or underinsured despite the expansion of public and private health coverage options. For those who fall through the cracks—whether due to immigration status, income gaps, or eligibility exclusions—Charity Care Programs offer a critical lifeline. These programs, administered by hospitals and health systems, provide free or reduced-cost medical services to patients who cannot afford to pay.

In this article, we examine what charity care is, who qualifies, how programs vary by state, their challenges, and what the future may hold in a rapidly evolving healthcare landscape.

What Is Charity Care?

Charity care refers to healthcare services provided at no charge or a discounted rate to patients who meet certain income or hardship criteria. Unlike Medicaid, charity care is not funded by insurance or federal programs—it’s primarily subsidized by nonprofit hospitals as part of their community benefit obligation.

Charity care is not the same as bad debt. While bad debt is money owed by patients who fail to pay, charity care is planned, documented relief provided to those who qualify through an application process.

Key Components of Charity Care Programs

Most charity care programs share the following features:

-

Income eligibility thresholds (usually based on the Federal Poverty Level, or FPL)

-

Residency or service-area requirements

-

No insurance, or insurance that doesn’t cover the full cost

-

Sliding scale discounts depending on income

-

Application and verification process

Some programs also waive charges for emergency care regardless of documentation or income verification.

How Many People Benefit from Charity Care?

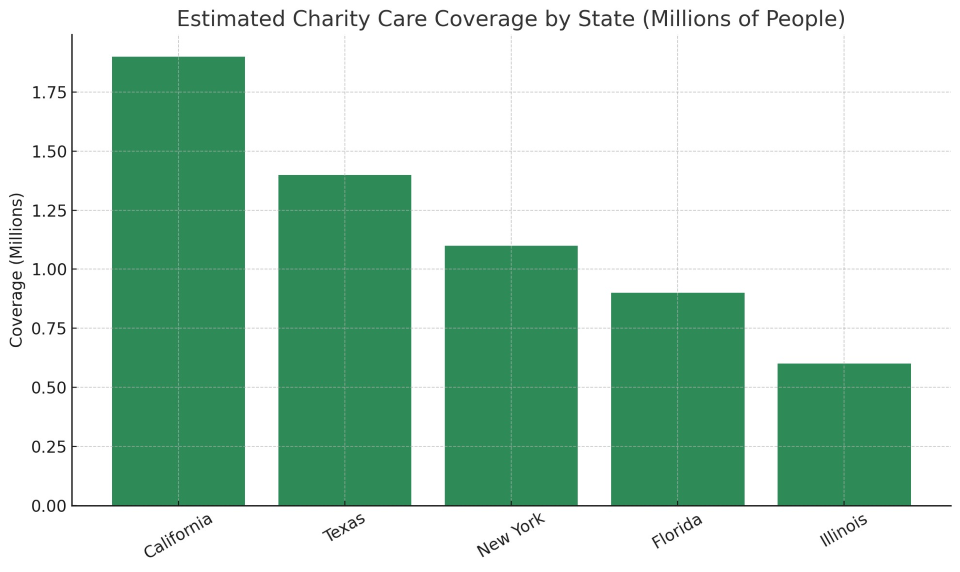

The number of people relying on charity care varies significantly by state, reflecting different levels of need, hospital policy, and Medicaid expansion status.

Types of Services Covered

Charity care programs may include full or partial financial relief for:

-

Emergency department visits

-

Inpatient hospital stays

-

Surgeries and follow-ups

-

Diagnostic tests and lab work

-

Prenatal and maternity care

-

Outpatient clinic visits

-

Medications and discharge prescriptions

Important note: Many programs exclude elective procedures, and some limit coverage for non-urgent outpatient services.

Case Example: How Charity Care Saved a Life

Patient: Maria, 42, undocumented immigrant in Houston

Situation: Suffered from untreated diabetes, avoiding hospitals due to fear of costs

Resolution: After collapsing from high blood sugar, she was taken to a county hospital. A charity care caseworker helped enroll her in the Harris Health Financial Assistance Program.

Outcome: Maria received insulin, nutrition counseling, and ongoing outpatient follow-up—all free of charge.

Charity care doesn’t just save money—it saves lives.

Eligibility Criteria (General Guidelines)

-

Income: Typically under 200–400% of the FPL

-

Insurance status: Uninsured or underinsured

-

Citizenship: Varies by provider—some require legal status, others don’t

-

Residency: Proof of local address required for most programs

-

Documentation: Income verification via tax forms, pay stubs, or letters from employers

Some states and nonprofit systems simplify enrollment through presumptive eligibility based on enrollment in SNAP, SSI, or housing aid programs.

Estimated Charity Care Coverage by State

While Texas has the highest uninsured rate, California provides charity care to more people, due in part to more aggressive hospital system funding and expanded Medicaid-like programs.

Challenges Facing Charity Care Programs

Charity care, while crucial, faces major operational and ethical challenges:

1. Inconsistent Program Standards

There is no federal mandate for how charity care must be administered. Hospitals define their own eligibility rules, which leads to confusion and uneven access.

2. Hospital Compliance

Not all hospitals clearly advertise or educate patients about charity care. In some cases, patients are sent to collections even when they may have qualified for free care.

3. Funding Shortfalls

Charity care is funded by hospital operating margins. When hospitals face financial pressures (e.g., from uninsured ER use or inflation), charity care budgets are often cut.

4. Administrative Barriers

Complex applications and documentation requirements discourage or prevent patients—especially those with language barriers or undocumented status—from applying.

Regulatory and Policy Landscape

IRS Regulations

Nonprofit hospitals must report community benefit activities—including charity care—on IRS Form 990 Schedule H to retain tax-exempt status.

State-Level Rules

Some states, like New Jersey and Massachusetts, have formal charity care funding pools. Others, like Texas, leave it entirely up to hospital discretion.

Recent Developments

In 2023, multiple states introduced legislation requiring hospitals to:

-

Publicly disclose charity care policies

-

Screen all uninsured patients before billing

-

Prohibit aggressive collections before eligibility determination

Future Directions and Innovations

Several trends aim to improve charity care:

-

Technology-driven screening (e.g., AI tools to flag eligibility in real-time)

-

EHR-integrated financial assistance alerts

-

Universal charity care standards under consideration by advocacy groups

-

Expansion of presumptive eligibility rules

Health equity advocates are pushing for automatic enrollment systems and centralized charity databases to streamline care for the uninsured.

Charity care programs are an essential, often invisible, pillar of the American healthcare system. For millions of uninsured patients, they are the only path to timely, life-saving care. As hospitals adapt to economic stress and policy changes, maintaining—and improving—charity care access is not just a moral imperative, but a public health priority.

Transparency, standardization, and innovation will be key in ensuring these programs fulfill their life-saving potential for those who need it most.