In the U.S., health insurance isn’t just a financial tool—it’s a gateway to care. Whether it’s a planned surgery, emergency treatment, or chronic condition management, having insurance—and what type you have—shapes how and when you visit the hospital.

This article breaks down how insurance status influences hospital visits, which insurance groups use hospitals most frequently, and how access, cost, and outcomes are all tied to coverage.

Hospital Visits by Insurance Type

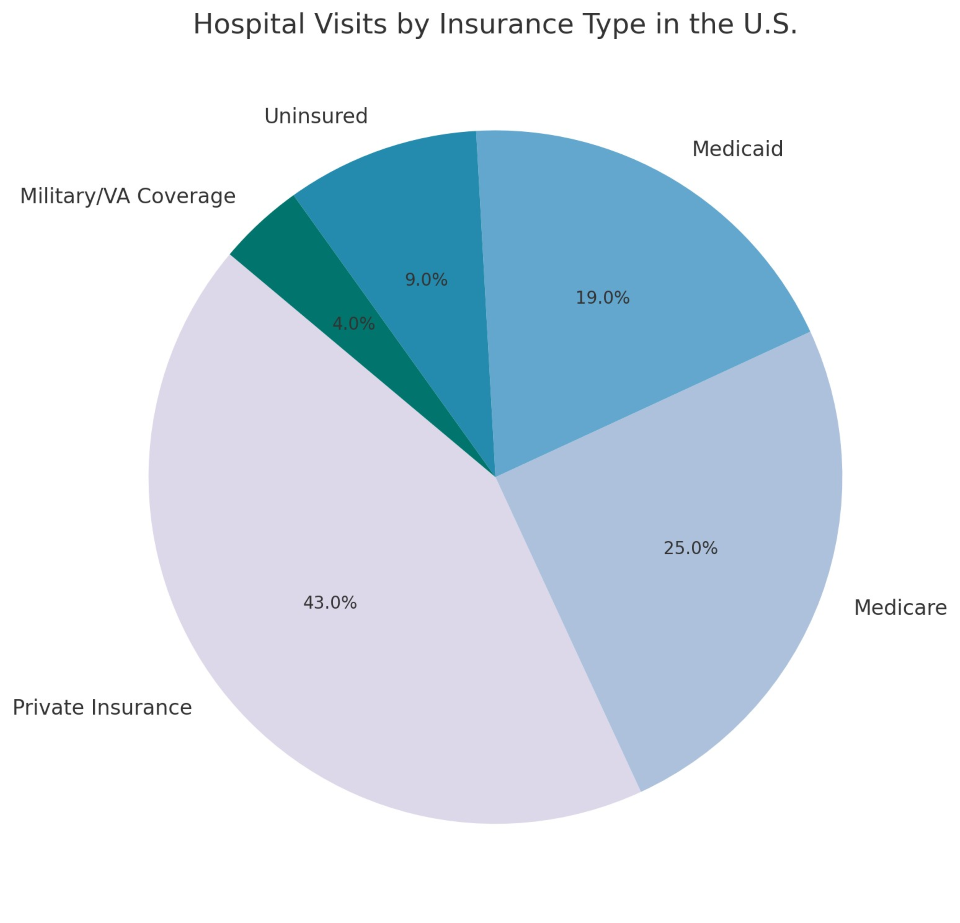

Hospital Visits by Insurance Type in the U.S.

The chart shows that privately insured patients make up the largest share of hospital visits, followed by Medicare and Medicaid beneficiaries. While the uninsured make up a smaller percentage, their visits often reflect emergency use or delayed care—resulting in more severe conditions.

How Health Insurance Influences Hospital Access

Health insurance affects nearly every part of the hospital experience:

-

Whether you go to the ER or wait it out

-

What tests or treatments are approved

-

Which hospitals or specialists you can see

-

How much you pay out-of-pocket

Those with private insurance generally have wider provider networks, while public insurance options like Medicaid or Medicare may be more limited—but often more affordable.

Private Insurance: The Largest Group

About 60% of Americans have private insurance—either employer-sponsored or through the individual marketplace.

Impact on Hospital Visits:

-

Shorter wait times for elective surgeries

-

Access to a broader range of specialists

-

Higher out-of-pocket costs (deductibles, copays)

-

More preventive visits, reducing emergency room use

While private insurance allows flexibility, it can come with high cost-sharing, making hospital visits expensive if not budgeted.

Medicare: Coverage for Seniors and the Disabled

Medicare serves those 65+ and people with disabilities. It covers:

-

Inpatient and outpatient hospital services

-

Rehabilitation and skilled nursing

-

Some prescription drugs (Part D)

Visit Patterns:

-

More frequent hospital stays (due to age-related illness)

-

Increased usage of surgical and cardiac services

-

Often followed by rehabilitation care or home health

Medicare patients typically have longer hospital stays and more complex medical needs.

Medicaid: Safety-Net Coverage for Low-Income Individuals

Medicaid is jointly funded by states and the federal government. It covers low-income individuals, families, pregnant women, and children.

In Hospitals:

-

High emergency room usage

-

Delayed elective procedures

-

Challenges with provider acceptance

Despite offering full coverage with little to no copay, Medicaid patients often face longer wait times or limited access to specialists due to low reimbursement rates for providers.

Uninsured Patients: Delayed, Disconnected, and At Risk

Roughly 9% of hospital visits are made by people without insurance. These are often emergencies, because uninsured individuals:

-

Avoid care due to cost

-

Lack access to regular doctors

-

Present with more advanced illness

-

Face large medical debt after hospitalization

Hospitals must treat emergencies regardless of insurance (under EMTALA), but many uninsured patients don’t receive follow-up care, worsening long-term health outcomes.

Military/VA Coverage

Veterans and active-duty military often receive care through:

Although only 4% of hospital visits, these patients typically receive integrated, federally managed care, often coordinated between VA facilities and external providers.

Insurance Status and Emergency Room Use

Emergency departments are a major point of access for all insurance types—but patterns differ:

Medicaid and uninsured patients rely more heavily on ERs for primary care-level problems, driving up costs and crowding facilities.

Financial Impact on Hospitals

Hospitals receive different reimbursement rates depending on the insurance:

-

Private Insurance: Highest reimbursement

-

Medicare: Moderate, fixed by federal rates

-

Medicaid: Often lowest; doesn’t cover full costs

-

Uninsured: High risk of uncompensated care

As a result, hospitals in low-income areas with high Medicaid and uninsured populations face more financial stress—even though they serve more critical needs.

Improving Access and Reducing Inequality

Efforts to reduce hospital reliance and improve access include:

-

Expanding Medicaid in more states

-

Subsidizing private insurance premiums under the ACA

-

Launching charity care and financial assistance programs

-

Increasing funding for community health centers

-

Encouraging value-based care models over fee-for-service

These changes aim to reduce preventable hospitalizations and improve continuity of care across all insurance types.

Technology's Role in Bridging Gaps

Tools that improve equity across insurance groups:

-

Telehealth: Lowers transportation and wait-time barriers

-

EHR integration: Streamlines treatment across providers

-

Cost transparency tools: Help patients compare hospital pricing

-

AI for predictive care: Prevents readmissions and ER overuse

Hospitals using these technologies have seen improvements in patient follow-up, lower readmission rates, and better chronic disease management.

Hospital visits in the U.S. are deeply tied to insurance status. While private insurance offers more options, it can be expensive. Medicare and Medicaid offer wide coverage but face system challenges. Uninsured patients often suffer the most—from delayed care, poor outcomes, and crushing medical bills.

Improving insurance access and modernizing care models will be essential to making hospital services more equitable, efficient, and effective—for everyone.