Navigating the U.S. healthcare system can be financially daunting. For millions of Americans, the cost of care—from hospital bills to medications—can become a barrier to getting the help they need. That’s where financial assistance programs come in. These initiatives are designed to reduce the economic burden of healthcare, especially for low-income and uninsured individuals.

This article explores the different types of financial assistance available, eligibility criteria, success rates, and the growing importance of healthcare affordability in an inflation-driven economy.

What Is Healthcare Financial Assistance?

Financial assistance in healthcare refers to a range of programs that reduce or eliminate medical costs for qualifying individuals and families. These include both public and private programs and can apply to hospital bills, prescriptions, primary care, and more.

Unlike insurance, which offers broad coverage, financial assistance tends to be situational and income-based—it kicks in when a person cannot afford to pay for a specific type of care or service.

Key Types of Financial Assistance Programs

These programs serve different roles—from reducing inpatient hospital bills to subsidizing insurance premiums or medications. Access varies by state, institution, and funding.

Common Eligibility Requirements

Although criteria differ, most financial aid programs assess:

-

Household income (usually as a percentage of the Federal Poverty Level)

-

Insurance status (uninsured or underinsured)

-

Residency and citizenship (varies; some exclude undocumented individuals)

-

Medical need or diagnosis

-

Asset limits for some hospital-based programs

Some states and hospitals now use automated screening tools that pull data from other benefits programs (like SNAP or SSI) to make faster decisions.

Case Example: Financial Relief in Action

Patient: Martin, 60, recently unemployed, uninsured

Bill: $8,300 for a 3-day hospital stay

Action: Hospital staff referred him to the charity care coordinator

Outcome: Application approved in 10 days; 100% of the bill forgiven

Martin was also connected to a community health clinic for follow-up at a reduced fee. For many patients like him, financial assistance prevents not only debt—but also future health decline due to cost-related care avoidance.

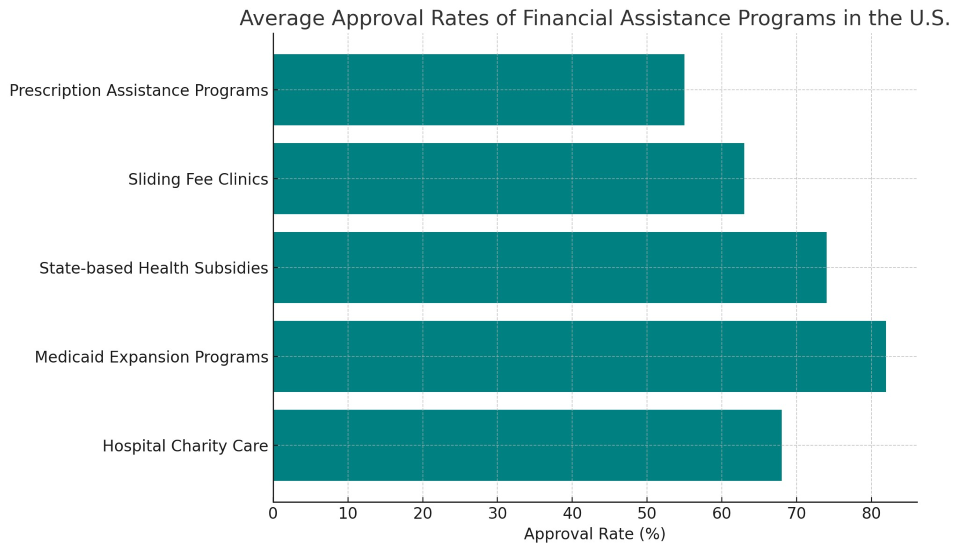

Financial Assistance Program Approval Rates

This chart shows that Medicaid expansion and state subsidies tend to have higher approval rates, while prescription assistance programs are the most restrictive, often requiring paperwork from doctors and pharma companies.

How Hospitals Handle Financial Aid

Many nonprofit hospitals in the U.S. are legally required to provide financial assistance. To maintain tax-exempt status, they must:

-

Maintain a written Financial Assistance Policy (FAP)

-

Publicly post and translate that policy

-

Screen patients before billing or collections

-

Report financial aid in IRS Form 990 Schedule H

Despite these rules, audits show that some hospitals fail to notify eligible patients, leading to avoidable debt and even legal action. Several states are now enacting laws to mandate presumptive eligibility screenings and restrict collections against qualifying individuals.

Sliding Fee Scale Clinics

Also known as Federally Qualified Health Centers (FQHCs) or community clinics, these centers base patient fees on income and family size. Patients earning under 200% of the Federal Poverty Level often pay as little as $10–$20 per visit.

Services include:

-

Primary and preventive care

-

Dental and vision screenings

-

Women’s health and prenatal care

-

Mental health counseling

These clinics are crucial in rural areas and underserved urban neighborhoods, where traditional private practices are scarce.

Prescription Assistance Programs (PAPs)

Run by pharmaceutical companies or nonprofit groups, PAPs offer:

These programs require applications, doctor verification, and sometimes strict income limits. Some are limited to specific brand-name drugs, excluding generics.

Barriers to Accessing Financial Assistance

Even when help exists, many patients don’t receive it. Common challenges include:

-

Lack of awareness that aid exists

-

Complex applications requiring multiple documents

-

Language and literacy barriers

-

Long processing times

-

Mistrust or fear (especially among undocumented individuals)

Hospitals and clinics are starting to respond by training patient navigators, simplifying forms, and integrating financial screening into EHR systems.

Technology’s Role in Expanding Access

Digital solutions are transforming financial aid access:

-

Online applications with instant eligibility estimates

-

Mobile apps for prescription discount programs

-

AI tools that scan health records for financial risk indicators

-

Text and email alerts to guide patients through applications

Hospitals using these systems report faster approvals and higher patient satisfaction.

Policy Spotlight: The Inflation Reduction Act (IRA) and Affordability

Signed in 2022, the IRA extended ACA premium subsidies and capped Medicare drug costs for seniors. It also allowed Medicare to negotiate drug prices for the first time—potentially saving billions and helping older adults on fixed incomes avoid treatment delays due to cost.

Financial assistance programs may not fix all the flaws in the U.S. healthcare system, but for the individuals they help, they mean everything. From covering an ER visit to securing a life-saving medication, these programs are a critical part of the healthcare safety net.

As costs continue to rise and more patients struggle with access, the demand for clearer policies, simpler systems, and better outreach will only grow. Financial assistance should not be a last resort—it should be a well-known, well-run bridge to healthier outcomes.