In the complex U.S. healthcare system, millions of people still fall through the cracks. Whether due to unemployment, immigration status, or gaps in public programs, many patients cannot afford necessary medical care. Charity care—hospital-funded financial assistance for low-income or uninsured patients—serves as a lifeline in these situations.

While often underpublicized and inconsistent across the country, charity care plays a crucial role in maintaining access and equity in healthcare. This article breaks down what charity care is, who qualifies, what’s covered, and how states differ in their support and structure.

What Is Charity Care?

Charity care refers to medical services offered free or at a reduced cost to eligible patients. Unlike Medicaid or Medicare, this assistance is not based on enrollment in a public insurance program. It’s usually administered by nonprofit hospitals, which are required to provide community benefits in exchange for their tax-exempt status.

The patient must typically apply for charity care and meet certain income and documentation criteria. Once approved, some or all of their bills may be waived.

Services Typically Covered

Charity care varies by provider, but generally includes:

-

Emergency room visits

-

Surgeries and inpatient stays

-

Diagnostics (lab tests, imaging)

-

Prenatal and postnatal care

-

Follow-up outpatient visits

-

Discharge medications (sometimes)

Services such as cosmetic procedures or elective surgeries are almost always excluded.

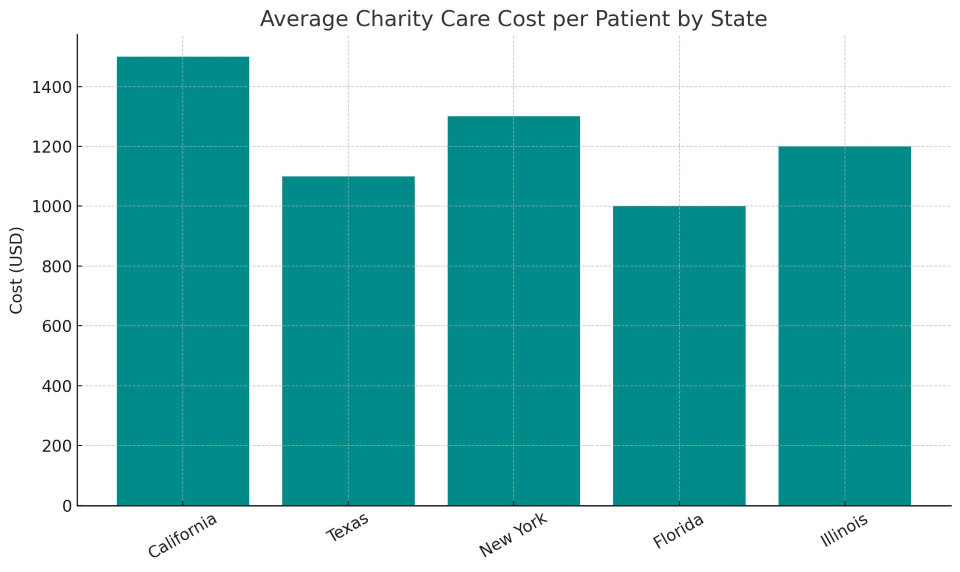

Updated State-Level Data: Cost and Support Index

Different states take different approaches to supporting charity care programs. Below is an overview of average charity care costs per patient and an index measuring how actively states fund or support hospital-based financial aid.

Eligibility Requirements

Although eligibility rules vary, most programs require:

-

Household income between 0–400% of the Federal Poverty Level (FPL)

-

Uninsured or underinsured status

-

Residency in the hospital’s service area

-

Proof of financial hardship (pay stubs, tax returns, unemployment letters)

Some hospitals offer presumptive eligibility if patients receive SNAP, SSI, or public housing benefits.

Case Example: Real Impact of Charity Care

Patient: Ana, 47, part-time restaurant worker in Florida

Situation: Needed emergency gallbladder surgery but lacked insurance

Action: Hospital social worker helped her apply for their charity program

Result: Entire $14,000 hospital bill was forgiven. Ana was also connected to follow-up care through a sliding-fee clinic.

Without charity care, Ana may have avoided the ER entirely—putting her life at risk.

Average Charity Care Cost per Patient by State

This chart shows how state support levels and average costs differ, underscoring the lack of national consistency in charity care policies.

Charity Care vs. Bad Debt

Hospitals often distinguish between:

Unfortunately, many patients who might qualify for charity care end up listed as bad debt simply because they never knew to apply. Hospitals are increasingly being required to screen all patients before pursuing aggressive billing.

Challenges Facing Charity Care

Despite its importance, charity care faces numerous issues:

1. Lack of Transparency

Hospitals aren’t always clear about who qualifies or how to apply. Some don’t post policies online or in multiple languages.

2. Complex Applications

The documentation burden can be overwhelming, especially for non-English speakers, undocumented patients, or those without permanent housing.

3. Funding Volatility

Charity care is often financed from hospital operating margins, making it vulnerable to economic downturns or hospital consolidation.

4. Uneven Access

Some states fund centralized charity pools (like New Jersey); others leave it entirely to hospital discretion (like Texas).

Policy Landscape and Regulation

Federal Guidelines

-

IRS requires nonprofit hospitals to file Schedule H annually to justify their tax-exempt status via community benefits.

-

Hospitals must post financial assistance policies and make “reasonable efforts” to inform patients before sending them to collections.

State-Level Mandates

-

New York requires hospitals to dedicate a set portion of funding to financial aid.

-

California caps how much low-income patients can be charged.

-

Illinois mandates charity care discounts based on income and asset thresholds.

Modernizing Charity Care: What’s Next?

Several trends aim to make charity care more accessible and effective:

-

EHR Integration: Hospitals are building financial screening directly into electronic health records

-

Digital Portals: Online applications with real-time eligibility screening

-

Community Outreach: Training social workers and clinic staff to proactively guide patients

-

Universal Screening Mandates: Advocated by equity groups to prevent eligible patients from being missed

States like Oregon and Washington are exploring public-private partnerships to stabilize charity care funding across hospital systems.

Charity care remains one of the most critical, yet least understood, safety nets in American healthcare. For millions of patients, it’s the only path to lifesaving care. However, its impact is diluted by inconsistency, lack of awareness, and administrative friction.

To build a more equitable healthcare system, charity care programs must become simpler, smarter, and standardized. Transparency, automation, and state-level support are key steps forward.