Healthcare in the U.S. is expensive—sometimes unexpectedly so. Even with insurance, patients often face high deductibles, copays, or services not covered at all. For millions of Americans, these gaps are filled with a rising financial tool: the medical loan.

Medical loans are personal loans or in-house financing plans specifically used to cover healthcare costs. They offer fast access to treatment, but come with risks, fees, and long-term consequences if not used carefully.

This article explores what medical loans are, how they work, who uses them, and what to watch for before signing on the dotted line.

What Are Medical Loans?

A medical loan is a type of financing used to pay for health-related expenses. These can include personal loans from banks, special credit lines from providers, or financing through third-party healthcare lenders like CareCredit, LendingClub, or Affirm.

Types of Medical Loans:

-

Unsecured Personal Loans: Offered by banks or online lenders

-

Credit-Based Medical Financing: Often through companies partnering with clinics

-

Provider Installment Plans: Set up directly with hospitals, dentists, or surgeons

-

Buy Now, Pay Later (BNPL): Short-term, low- or no-interest options for minor procedures

These loans can range from a few hundred dollars to over $30,000, depending on the procedure and the lender.

Why Do People Use Medical Loans?

Medical loans are most commonly used for unplanned emergencies and elective treatments not covered by insurance, such as cosmetic surgery or fertility care.

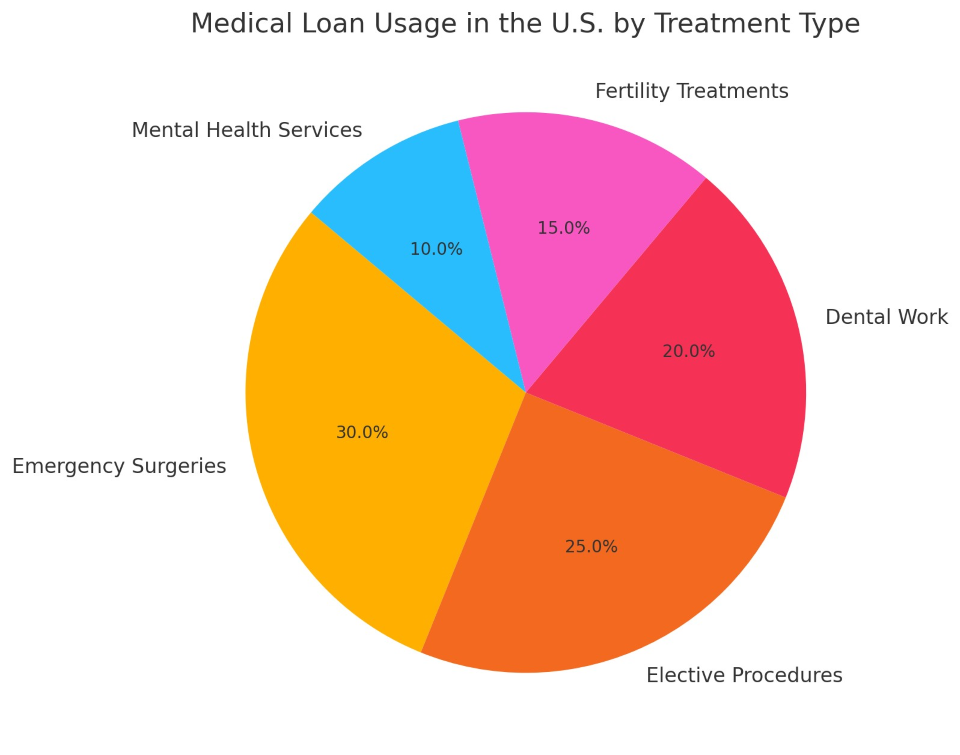

Medical Loan Usage by Treatment Type

This pie chart clearly illustrates how emergency surgeries and elective procedures make up over half of medical loan usage, while areas like dental and mental health services—often poorly covered by insurance—also contribute significantly.

Case Study: The Role of a Medical Loan in a Real Patient's Life

Patient: Rachel, 33, underwent an emergency appendectomy

Insurance: High-deductible plan with $7,500 out-of-pocket maximum

Problem: She owed $5,200 and didn’t have the savings to cover it

Solution: Took out a 2-year medical loan through a provider partner lender

Terms: 11.9% APR, $247/month

Result: Rachel avoided collections and protected her credit, but ended up paying nearly $800 in interest—making her total repayment just over $6,000.

Who Offers Medical Loans?

Advantages of Medical Loans

-

Fast approval (sometimes same-day)

-

Flexible repayment options (6 to 60 months)

-

May allow access to care that might otherwise be delayed or denied

-

Protects credit when compared to unpaid bills going to collections

They can be particularly valuable when timing is critical—such as in dental emergencies or fertility cycles.

Drawbacks and Risks to Consider

-

High interest rates (often 9–26%)

-

Deferred interest traps (e.g., CareCredit 0% offers that become retroactive if not paid off)

-

Prepayment penalties in some contracts

-

Impact on credit score if payments are missed

Not all medical loans are created equal, and predatory lending remains a concern, especially in cosmetic and fertility sectors.

Medical Loans vs. Medical Credit Cards

While similar, there are differences:

Some patients use both—taking a loan for surgery and credit for ongoing therapy or prescriptions.

Alternatives to Medical Loans

Before signing a loan agreement, patients should explore:

-

Hospital financial assistance or charity care

-

Negotiating cash prices

-

Payment plans without interest

-

Crowdfunding (e.g., GoFundMe)

-

Health savings accounts (HSAs) if available

Patients should also ask their providers about bundled pricing and sliding scale discounts.

Regulatory and Legal Considerations

As medical loans become more common, lawmakers are taking notice. Recent developments include:

-

FTC crackdowns on misleading financing terms

-

State-level caps on APRs for patient financing

-

CFPB investigations into medical credit practices

-

Pushes for "Truth in Lending" disclosures before patients sign

Several states now require that hospitals disclose charity care options before offering a loan.

Tips Before You Borrow

-

Read the full contract including APR, fees, and penalties

-

Check your credit score before applying

-

Ask about financial aid or sliding scale alternatives first

-

Use the shortest loan term you can afford to minimize interest

Even a 24-month loan at 12% interest adds hundreds of dollars to the original bill.

Medical loans can offer a lifeline in a moment of crisis—but they’re not a perfect solution. Used wisely, they can prevent collections and preserve access to essential care. Used hastily, they can become a costly burden.

As healthcare affordability continues to be a national concern, understanding your financing options, risks, and rights is more important than ever. The best financial decision is an informed one.