In the vast and often fragmented landscape of healthcare in the United States, not every patient interaction happens inside a hospital. Increasingly, care is shifting to outpatient settings, and partner facilities are a big part of that evolution. These facilities are quietly reshaping access, cost, and quality across the system—and yet, they remain underrecognized by most patients.

If you've ever had lab work done at a local clinic connected to your hospital, or seen a specialist at an offsite facility that shares your doctor’s network, you've likely used a partner facility. So, what exactly are these places, and why are they becoming so important?

Defining a Partner Facility

A partner facility is a healthcare organization that operates in formal collaboration with a larger hospital or health system. It’s not an independent provider, but rather an integrated or affiliated facility that helps extend the reach, services, and operational capacity of a larger care network.

These facilities may offer:

-

Outpatient services (diagnostics, imaging, surgeries)

-

Specialty care (oncology, cardiology, orthopedics)

-

Post-acute care (rehab, physical therapy, home health)

-

Chronic disease management

-

Telemedicine infrastructure

-

Behavioral health services

They’re often smaller, more specialized, and more nimble than hospitals. But their defining feature is collaboration—they’re connected through shared electronic health records, aligned care plans, and often shared risk in value-based care models.

The Strategic Role of Partner Facilities

Partner facilities serve four major purposes in the healthcare delivery chain:

1. Enhancing Access

Hospitals, particularly in urban areas, can be overwhelmed. Partner facilities offer faster access to routine and specialty care. They're often located in retail corridors, suburban hubs, or even inside pharmacies—bringing care closer to patients.

2. Reducing Costs

Cost control is a major concern in the U.S. health system. Delivering a service at a hospital is significantly more expensive than doing the same in a specialized outpatient setting. For example, a colonoscopy in a hospital may cost $3,000+, while the same procedure in an ambulatory surgical center (ASC) might cost $1,200.

3. Improving Outcomes

By focusing on specific services, partner facilities can hone their processes, reduce complications, and improve outcomes. A physical therapy clinic that sees hundreds of post-surgical patients a month is likely to be more efficient and effective than a generalist department in a hospital.

4. Supporting Care Coordination

In a fragmented system, coordination is often poor. Partner facilities help providers centralize patient data, share test results, and ensure follow-ups happen without patients falling through the cracks.

Healthcare Facility Comparison

Here’s how partner facilities stack up against other healthcare settings:

Growth in the U.S. Market

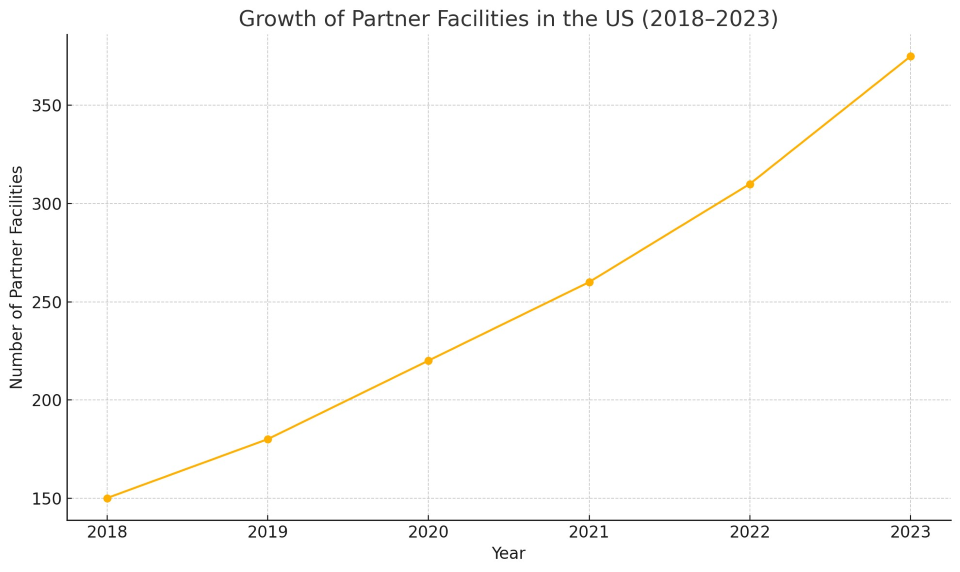

The rise of partner facilities isn’t just theoretical—it’s measurable. As healthcare systems move away from inpatient-centric models and embrace value-based care, they’re investing heavily in outpatient infrastructure.

Below is a graph illustrating the increase in the number of partner facilities between 2018 and 2023:

From 150 in 2018 to over 370 by 2023, the growth has been fueled by:

-

Hospital system expansion strategies

-

Private equity investment in outpatient care

-

Medicare reimbursement changes favoring non-hospital sites

-

Patient demand for convenience and affordability

Real-World Examples

1. Cleveland Clinic

Cleveland Clinic uses a hub-and-spoke model with numerous outpatient centers across Ohio and Florida. These centers provide imaging, minor procedures, and chronic disease management in a setting closer to patients’ homes.

2. Kaiser Permanente

As an integrated system, Kaiser operates hundreds of partner clinics that offer everything from dermatology to behavioral health. These facilities are deeply integrated with Kaiser’s electronic health records and care teams.

3. CVS Health and MinuteClinic

While not hospitals, CVS MinuteClinics act as partner facilities through affiliations with health systems in over 30 states. They handle basic care, diagnostics, and even chronic condition monitoring, feeding data into larger networks when appropriate.

Policy & Regulatory Environment

Partner facilities thrive in part due to shifting regulatory frameworks. Medicare, Medicaid, and private payers have increasingly supported these sites by:

-

Equalizing reimbursement between hospital and outpatient settings (site-neutral payment policies)

-

Encouraging telehealth integration

-

Promoting value-based contracts that incentivize care coordination

At the same time, the Centers for Medicare & Medicaid Services (CMS) is keeping a close eye on quality and accountability, requiring many partner sites to report performance data.

Key Benefits for Patients

When used effectively, partner facilities offer:

-

Faster appointments with specialists or diagnostics

-

Lower out-of-pocket costs (especially with high-deductible plans)

-

Easier navigation within a healthcare system

-

Localized care in communities, including rural areas

But it’s not all automatic. Patients need to understand how these facilities are connected to their providers and whether insurance networks include them.

Risks and Challenges

Despite the upside, there are real challenges:

-

Lack of uniform quality control across all facility types

-

Inconsistent data sharing, especially across unaffiliated systems

-

Equity gaps, with fewer facilities in low-income or rural areas

-

Confusion for patients, who may not know what a “partner” facility actually is

Solving these issues requires investment in health IT, workforce training, and stronger integration incentives.

A Growing Piece of the Puzzle

The U.S. healthcare system is increasingly shifting from a monolithic, hospital-based model to a decentralized, networked model—and partner facilities are at the center of this shift. They offer a way to scale services, manage costs, and improve patient experience in a system that often struggles with all three.

But to realize their full potential, partner facilities need to be more than just auxiliary providers. They need to be fully embedded in the care journey, with shared accountability, data, and quality standards.

As a patient, understanding this part of the system means you can make smarter, more informed choices about where you get care—and what it might cost. As a provider or policymaker, it means recognizing that the future of healthcare isn’t just in big hospitals. It’s also in these smaller, more agile facilities that are ready to meet patients where they are.